New data from the market intelligence firm GLASSNODE suggests that Bitcoin (BTC) could be approaching an early bear market phase. The crypto analytics platform highlights key indicators that historically precede a downturn in Bitcoin’s price cycle.

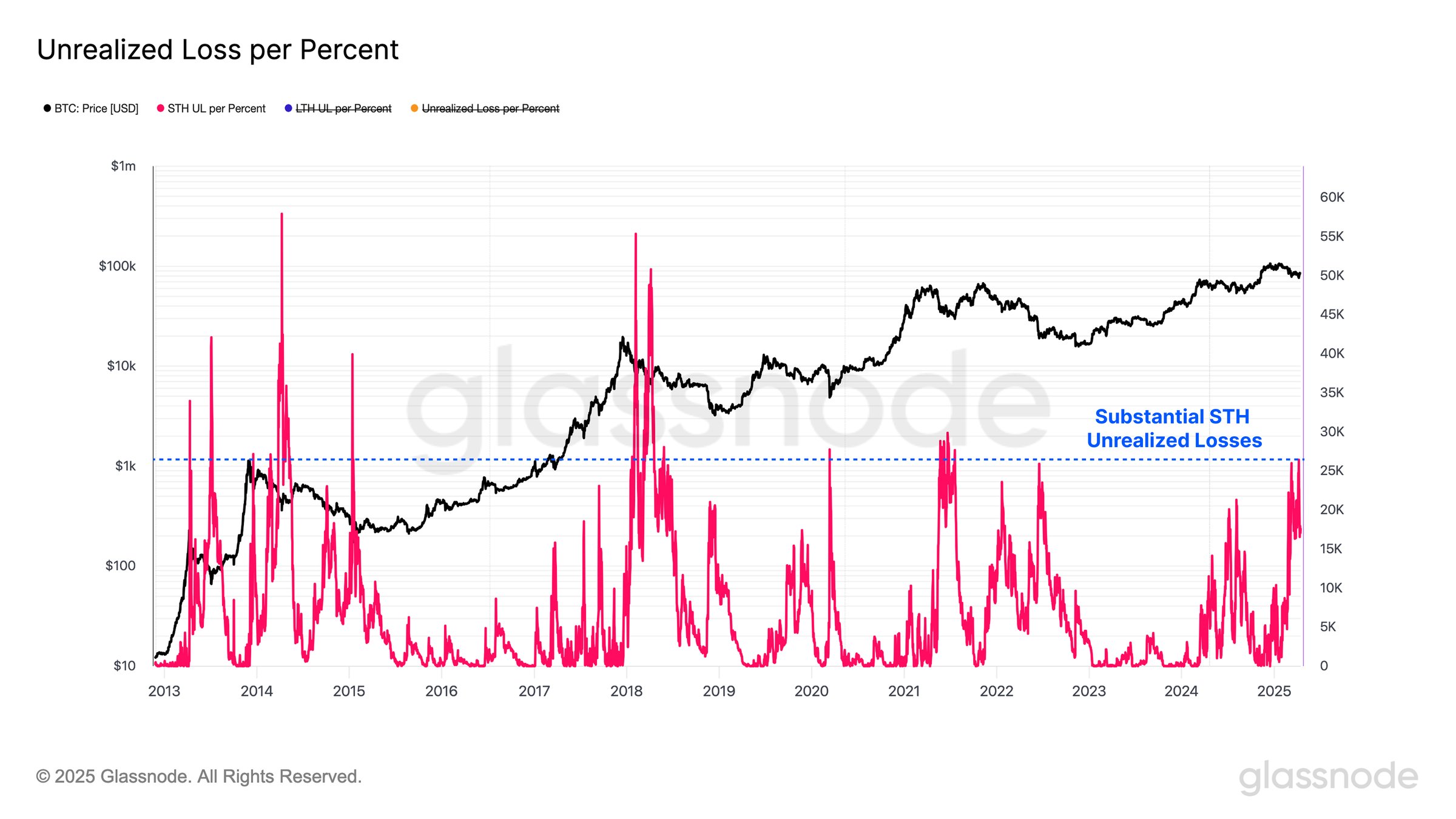

In a detailed analysis shared on social media platform X, GLASSNODE points out that short-term Bitcoin holders are currently experiencing significant unrealized losses relative to BTC’s current price. This scenario mirrors early bear market conditions observed in previous Bitcoin cycles.

“Bitcoin unrealized losses normalized by percentage drawdown show that short-term holders are already holding substantial losses relative to the current correction depth – comparable to early bear market conditions in past cycles.”

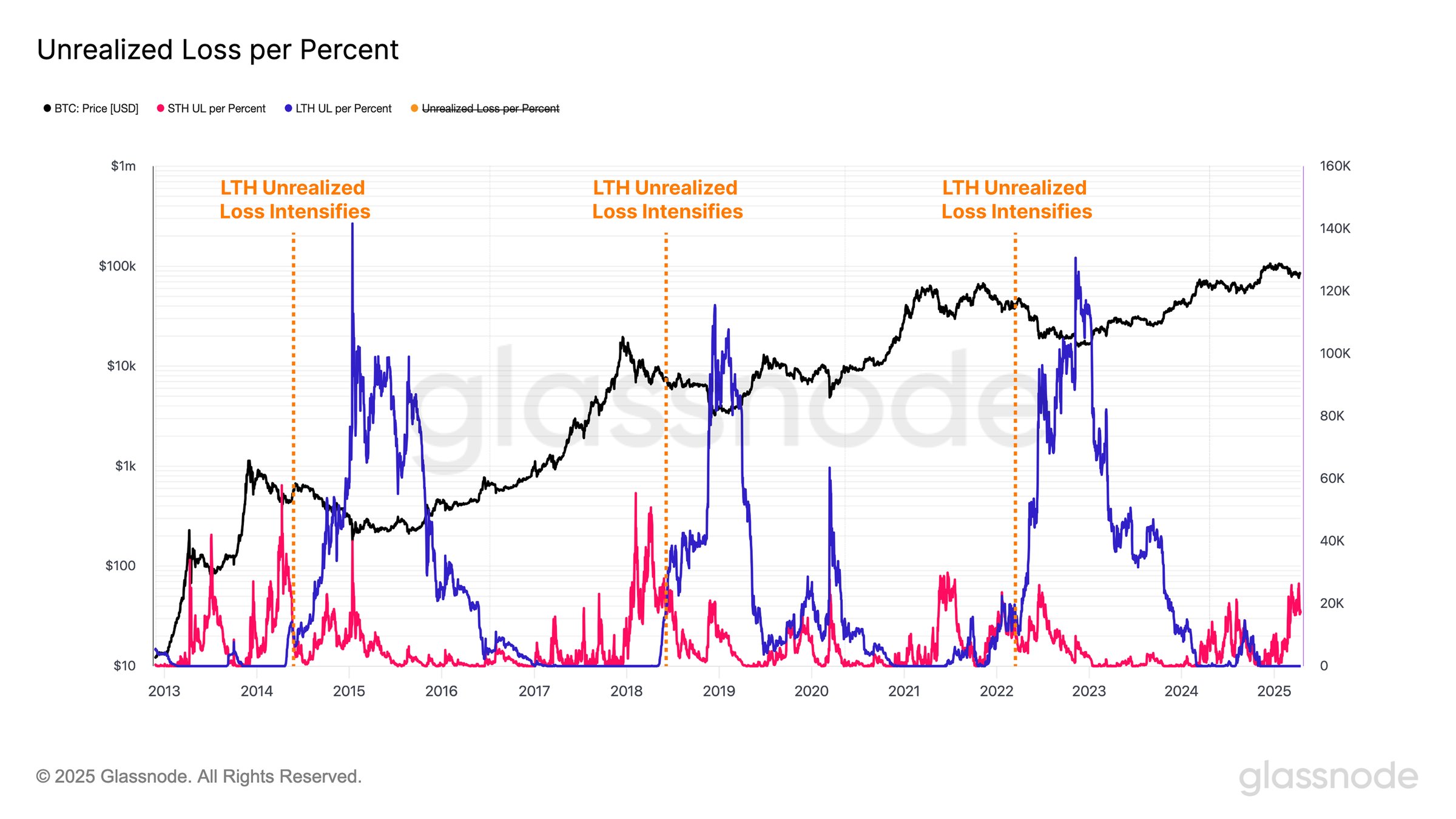

While long-term holders remain in profit, GLASSNODE warns that market conditions could erode these gains, signaling a potential shift toward a bearish phase.

“On the other hand, long-term holders (LTH) are still broadly in profit, but as BTC top buyers age into LTH status, loss absorption may rise. Historically, this shift often marked the confirmation of a bear market, though no such regime is evident yet.”

Short-term Bitcoin holders are defined as those who have held their tokens for less than 155 days, while long-term holders are those who have kept their assets inactive for 155 days or longer.

Additionally, GLASSNODE highlights a critical metric measuring the directional dominance of value flowing in or out of the Bitcoin network. This metric suggests that Bitcoin is at a pivotal juncture in determining its market direction.

“Meanwhile, volatility-adjusted net realized profit/loss for BTC has reverted to its long-term median. This historically marks the boundary between bull and bear regimes, placing the market at a critical juncture for determining direction.”

At the time of writing, Bitcoin is trading at $84,557, reflecting a marginal decline over the past 24 hours.

For more insights, visit GLASSNODE’s official analysis on X.