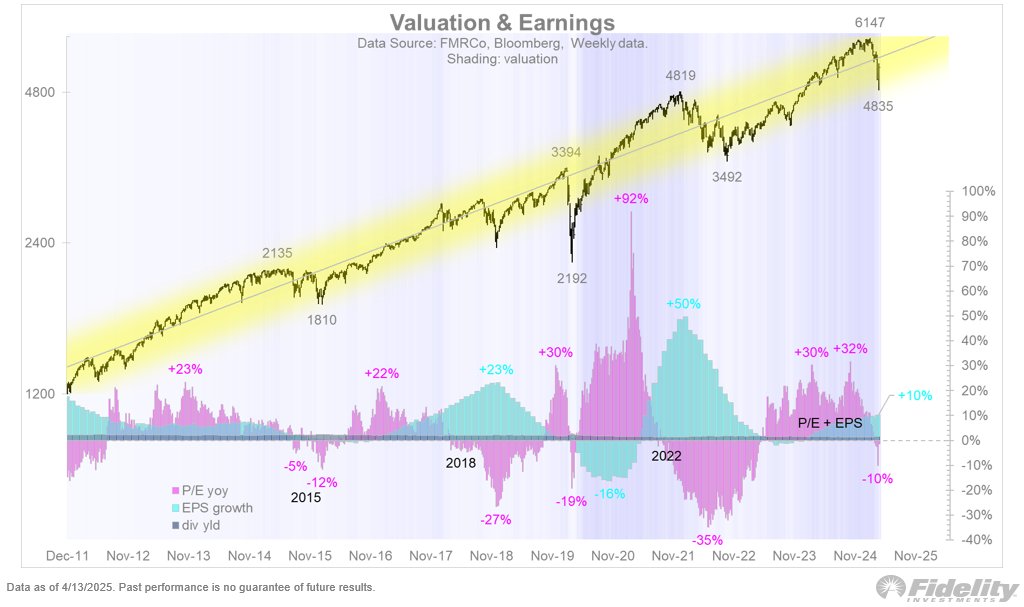

Fidelity Investments’ Global Macro Director, JURRIEN TIMMER, has projected a potential market recovery for the S&P 500, which has seen a decline of approximately 20% from its all-time high this year. Timmer shared his insights in a recent thread on the social media platform X, highlighting historical trends and investor sentiment.

Timmer noted that the S&P 500 has oscillated above and below a rising trendline since December 2011. The latest correction has pushed the index significantly below this trendline, creating a scenario ripe for a potential rebound. He stated, “Should the S&P 500 index overtake that breakdown point, it would happen after the index has fully swung from one extreme to another. The market, like a pendulum, moves from one end to the next, and in this case, it has shifted from well above the line to well below. This suggests that investors have priced in enough pain to make it worth taking the other side.”

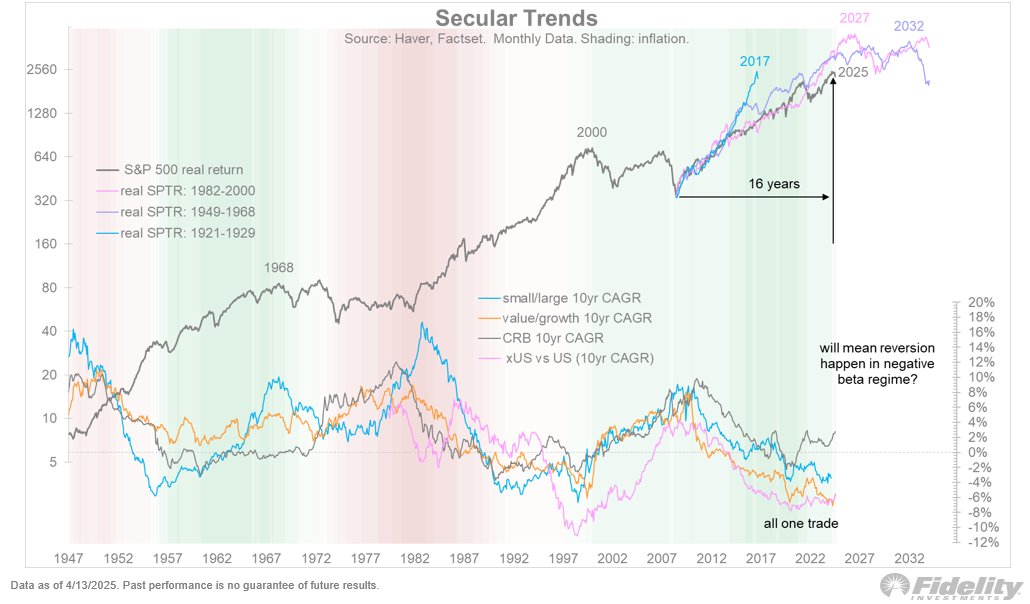

While optimistic about a short-term recovery, Timmer cautioned that the S&P 500’s long-term uptrend, which began in 2009, could be nearing its end. He believes that a shifting global order, characterized by de-globalization and de-dollarization, may prompt investors to reassess their positions in U.S. equities. “There is no getting around questioning the bullish secular regime in which we have been since the financial crisis ended in 2009. The timing of the cyclical drawdown raises questions about the state of the secular bull, which in my view is in its final years,” he explained.

Timmer also emphasized the potential for a shift in market leadership, with investors likely to favor fundamentally sound and undervalued stocks, including those outside the U.S. markets. “With the Mag 7 dominance now more than 10 years old and fraying, a rotation to value and international is likely to happen in a diminished secular beta regime,” he added.

As of Friday’s close, the S&P 500 was trading at 5,282 points. Timmer’s analysis underscores the potential for a near-term recovery while highlighting the broader structural changes that could redefine the global investment landscape.

Source: X