Bloomberg commodity strategist MIKE MCGLONE has issued a stark warning about the potential for a significant correction in US markets that could severely impact the prices of Bitcoin, oil, and stocks.

In a recent post on the social media platform X, MCGLONE highlighted the possibility of a “self-correcting mechanism” within the US economy that could counteract the effects of former President DONALD TRUMP‘s tariff policies, potentially triggering widespread market instability.

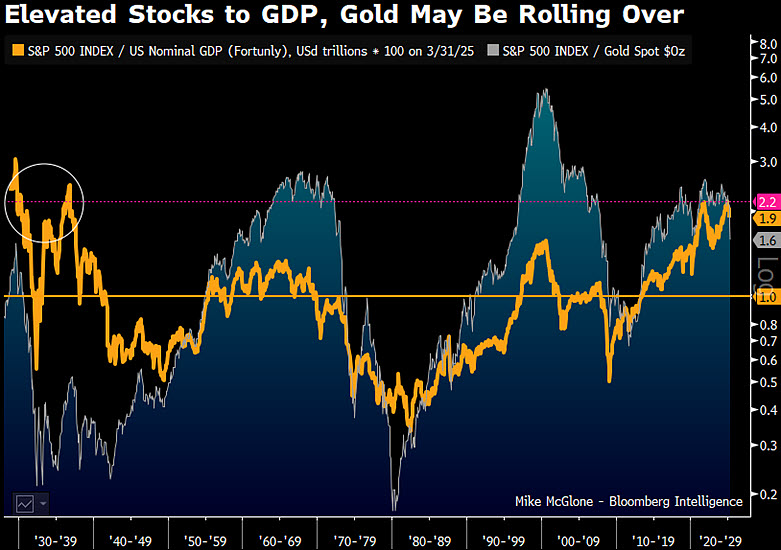

MCGLONE shared a chart indicating that the S&P 500-to-GDP ratio and the S&P 500-to-gold ratio are both at historically elevated levels—a pattern that has previously signaled major stock market crashes, including those in the 1930s, late 1990s, and 2008.

Such a reversion to the mean, according to MCGLONE, could lead to substantial declines in stocks, Bitcoin, oil, copper, and bonds. He outlined several potential outcomes based on historical trends:

- A 50% drawdown in the US stock market

- Crude oil at $40 per barrel

- Copper at $3 per pound

- US 10-year yields at 3%

- Bitcoin at $10,000, with 90% drawdowns across most cryptocurrencies

- Gold at $4,000, deemed an outlier due to its unique behavior

MCGLONE emphasized that while these predictions seem extreme, they align with historical patterns of market corrections. He noted, “America’s self-correcting mechanism is unstoppable. If unprecedented tariffs and austerity don’t work, pushback will come in the next elections. If the great rebalance attempt works, it could reset world order underpinnings for the coming century.”

At the time of writing, Bitcoin is trading at $87,529.

Generated Image: Midjourney

Source: MIKE MCGLONE‘s analysis on X